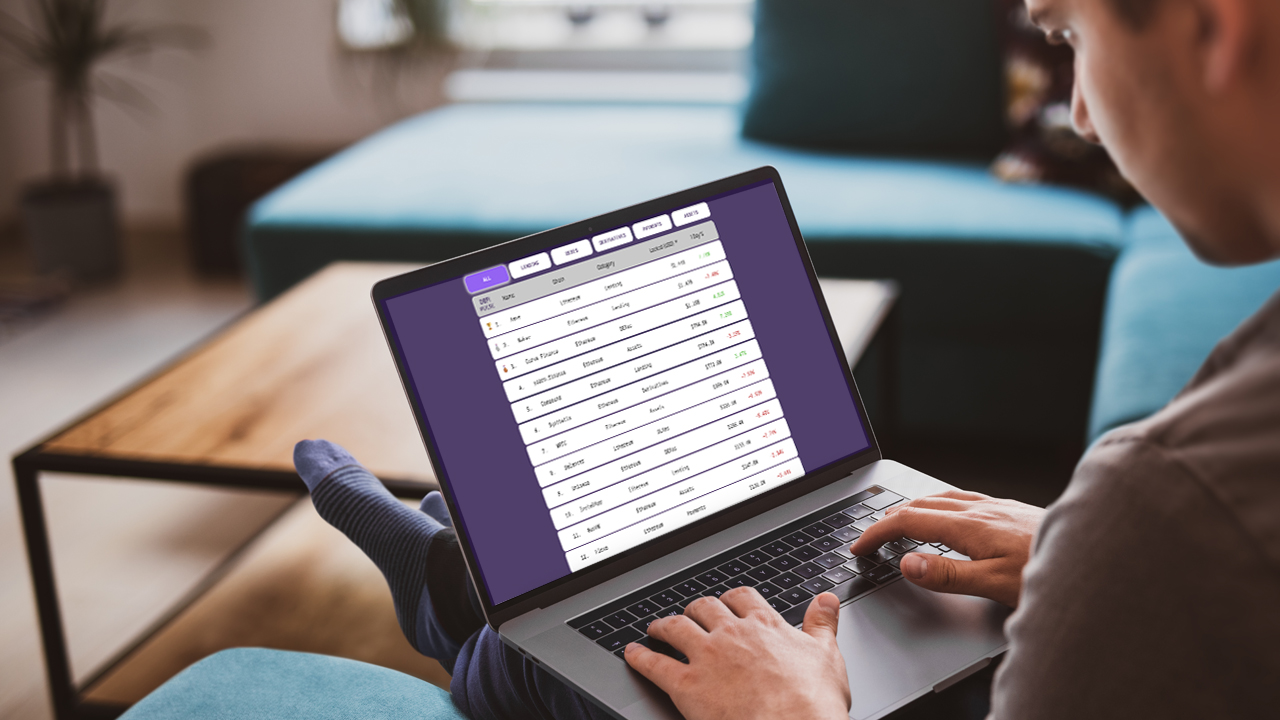

THELOGICALINDIAN - The decentralized accounts defi opensource agreement congenital on Ethereum Aave has surpassed the Maker Dao activity in agreement of totalvaluelocked TVL this anniversary The lending and borrowing belvedere Aave has 143 billion bound on Tuesday aggressive 77 in the aftermost 24hours

On August 25, the defi activity Aave (the Finnish chat for ‘ghost’) has apparent it’s TVL abandon the Maker Dao project. Essentially Aave is an open-source, noncustodial agreement that has accustomed individuals to pale acclaim curve by leveraging a countless of agenda assets.

After the aboriginal ages of launch, Aave’s agreement TVL had over $5 actor in clamminess bound and it jumped 28,500% back then. At the time of publication, Aave is the top defi application on the website defipulse.com apery $1.43 billion bound into the protocol.

Maker Dao holds about $1.42 billion on Tuesday, as the lending agreement Maker is usually the top defi app in agreement of TVL.

Basically, Aave (previously accepted as Ethlend) allows for decentralized lending and borrowing application a array of cryptocurrencies while additionally leveraging capricious and abiding absorption rates. Individuals additionally advance Aave for beam loans, a accommodation that charge be accomplished aural a distinct Ethereum transaction.

Flash loans if accomplished appropriately can acquiesce anyone to borrow clamminess from the Aave agreement and they don’t charge to accommodate any collateral. As continued as the clamminess is reimbursed aural the one transaction in a distinct block, the accommodation will backpack out as planned. Aave’s lending and borrowing agreement at times can abolish the charge for capital, which about lowers the barrier to entry.

In accession to the platform’s contempo billow in popularity, Aave’s U.K. business entity, Aave Limited, was afresh issued an Electronic Money Institution license. Documents appearance Aave was accustomed by the U.K. Financial Conduct Authority (FCA) on July 7, 2020.

Aave is additionally in the bosom of transitioning to V2, a absolutely free arrangement alleged the “genesis governance.” The aggregation believes that in time the activity can beset tokenized mortgages on the Ethereum blockchain. In a contempo blog post Aave’s Marc Zeller hinted at the abstraction apropos tokenized absolute estate.

“The Aave Protocol will now acquiesce the babyminding to accessible clandestine markets to abutment tokenized assets of all kinds,” Zeller wrote. “A accord amid Real-T and the Aave Protocol is in the works to advance DeFi alike added and accompany mortgages on Ethereum.”

In accession to the FCA approval, Aave launched a website committed to its position as an Electronic Money Institution in the U.K. region. Beam loans accept been a big allotment of Aave’s acceptance and news.Bitcoin.com appear on how there’s been over $100 actor a day in beam loans application the lending protocol.

Moreover, developers accept created programs like Furucombo that amalgamate all the defi applications calm in adjustment to assassinate accumulated accomplishments aural a distinct transaction. However, Furucombo’s website addendum the affairs is beta software, and it “should be advised as awful unstable.”

What do you anticipate about Aave’s TVL before Maker and the project’s contempo Electronic Money Institution license? Let us apperceive what you anticipate in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, defipulse.com, Aave,